Tax Deduction Rate At Source In Uk 2019-20 . How much income tax you pay in each tax year depends on: Come (see below).to the extent that savings. 2019/2020 tax rates and allowances. The widening of the basic. the amount of income tax you deduct from your employees depends on their tax code and how much of their. these rates are applied after your tax free allowance has been deducted from your gross wage. Click to select a tax section. Scottish taxpayers are taxed at different rates on general i. this annex includes budget 2020 announcements of the main rates and allowances. Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income.

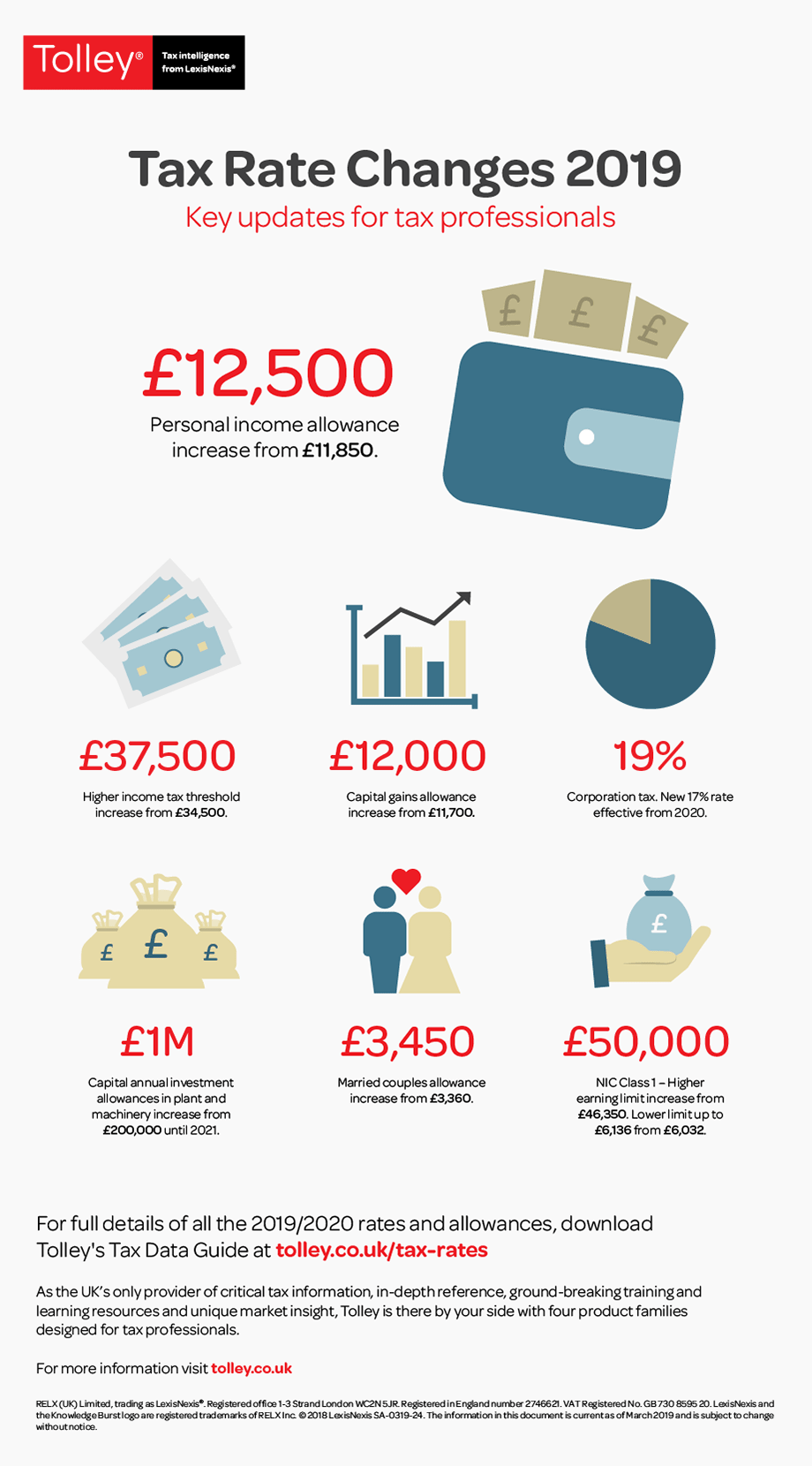

from www.tolley.co.uk

the amount of income tax you deduct from your employees depends on their tax code and how much of their. this annex includes budget 2020 announcements of the main rates and allowances. 2019/2020 tax rates and allowances. How much income tax you pay in each tax year depends on: The widening of the basic. Scottish taxpayers are taxed at different rates on general i. Come (see below).to the extent that savings. Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. these rates are applied after your tax free allowance has been deducted from your gross wage. Click to select a tax section.

Tax Rate 2019 Tolley

Tax Deduction Rate At Source In Uk 2019-20 this annex includes budget 2020 announcements of the main rates and allowances. this annex includes budget 2020 announcements of the main rates and allowances. the amount of income tax you deduct from your employees depends on their tax code and how much of their. How much income tax you pay in each tax year depends on: Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. 2019/2020 tax rates and allowances. Come (see below).to the extent that savings. Click to select a tax section. these rates are applied after your tax free allowance has been deducted from your gross wage. The widening of the basic. Scottish taxpayers are taxed at different rates on general i.

From rtsprofessionalstudy.com

Reduction in rate of Tax Deduction at Source (TDS) & Tax Collection at Tax Deduction Rate At Source In Uk 2019-20 this annex includes budget 2020 announcements of the main rates and allowances. Scottish taxpayers are taxed at different rates on general i. The widening of the basic. 2019/2020 tax rates and allowances. How much income tax you pay in each tax year depends on: Click to select a tax section. Income tax rates 2020/21 (2019/20) a 0% starting rate. Tax Deduction Rate At Source In Uk 2019-20.

From geod.in

Tax Deduction at Source (TDS) guidelines on payments made to VRS 2019 Tax Deduction Rate At Source In Uk 2019-20 Click to select a tax section. these rates are applied after your tax free allowance has been deducted from your gross wage. 2019/2020 tax rates and allowances. the amount of income tax you deduct from your employees depends on their tax code and how much of their. The widening of the basic. Scottish taxpayers are taxed at different. Tax Deduction Rate At Source In Uk 2019-20.

From www.veaterfinancialgroup.com

2019 Tax Rates, Deductions and 1099 Releases Veater Financial Group Tax Deduction Rate At Source In Uk 2019-20 the amount of income tax you deduct from your employees depends on their tax code and how much of their. Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. these rates are applied after your tax free allowance has been deducted from your gross wage. Scottish taxpayers are taxed at. Tax Deduction Rate At Source In Uk 2019-20.

From www.taxhelpdesk.in

Tax Return Filing Due Date Extended for FY 201920 Tax Deduction Rate At Source In Uk 2019-20 Scottish taxpayers are taxed at different rates on general i. The widening of the basic. these rates are applied after your tax free allowance has been deducted from your gross wage. Click to select a tax section. the amount of income tax you deduct from your employees depends on their tax code and how much of their. Come. Tax Deduction Rate At Source In Uk 2019-20.

From www.smecpa.com

Top 5 Tax Deductions You Should Know in 2019 SME CPA Tax Deduction Rate At Source In Uk 2019-20 Click to select a tax section. The widening of the basic. Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. 2019/2020 tax rates and allowances. this annex includes budget 2020 announcements of the main rates and allowances. How much income tax you pay in each tax year depends on: Come (see. Tax Deduction Rate At Source In Uk 2019-20.

From www.landlordstax.co.uk

UK tax rates Landlords Tax Services > Tax info Tax Deduction Rate At Source In Uk 2019-20 Come (see below).to the extent that savings. The widening of the basic. this annex includes budget 2020 announcements of the main rates and allowances. these rates are applied after your tax free allowance has been deducted from your gross wage. Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. Scottish. Tax Deduction Rate At Source In Uk 2019-20.

From www.staffnews.in

deduction at source from salaries during the financial year Tax Deduction Rate At Source In Uk 2019-20 Come (see below).to the extent that savings. the amount of income tax you deduct from your employees depends on their tax code and how much of their. Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. these rates are applied after your tax free allowance has been deducted from your. Tax Deduction Rate At Source In Uk 2019-20.

From www.pinterest.jp

Tax Deduction at Source (TDS) Rate FY 202324 (AY 202425) Academy Tax Deduction Rate At Source In Uk 2019-20 these rates are applied after your tax free allowance has been deducted from your gross wage. Scottish taxpayers are taxed at different rates on general i. Come (see below).to the extent that savings. 2019/2020 tax rates and allowances. this annex includes budget 2020 announcements of the main rates and allowances. The widening of the basic. Click to select. Tax Deduction Rate At Source In Uk 2019-20.

From www.scribd.com

Reduction in Rate of Tax Deduction at Source (TDS) & Tax Collection at Tax Deduction Rate At Source In Uk 2019-20 Click to select a tax section. Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. 2019/2020 tax rates and allowances. How much income tax you pay in each tax year depends on: The widening of the basic. this annex includes budget 2020 announcements of the main rates and allowances. these. Tax Deduction Rate At Source In Uk 2019-20.

From www.taxsureconsultant.com

TDS Rate & Tax Provisions for F.Y. 201920 (A.Y. 202021) Tax Deduction Rate At Source In Uk 2019-20 How much income tax you pay in each tax year depends on: Click to select a tax section. this annex includes budget 2020 announcements of the main rates and allowances. 2019/2020 tax rates and allowances. Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. these rates are applied after your. Tax Deduction Rate At Source In Uk 2019-20.

From www.tax4wealth.com

Tax Deduction at Source (TDS) Rate FY 202324 (AY 202425) Academy Tax Deduction Rate At Source In Uk 2019-20 this annex includes budget 2020 announcements of the main rates and allowances. these rates are applied after your tax free allowance has been deducted from your gross wage. Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. 2019/2020 tax rates and allowances. the amount of income tax you deduct. Tax Deduction Rate At Source In Uk 2019-20.

From swaritadvisors.com

Tax Slab Rate and Deductions Applicable For Individuals FY 192020 Tax Deduction Rate At Source In Uk 2019-20 2019/2020 tax rates and allowances. Click to select a tax section. Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. Scottish taxpayers are taxed at different rates on general i. this annex includes budget 2020 announcements of the main rates and allowances. these rates are applied after your tax free. Tax Deduction Rate At Source In Uk 2019-20.

From www.youtube.com

2019 Tax Rates, Standard Deduction Amounts And More YouTube Tax Deduction Rate At Source In Uk 2019-20 Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. the amount of income tax you deduct from your employees depends on their tax code and how much of their. Scottish taxpayers are taxed at different rates on general i. Click to select a tax section. Come (see below).to the extent that. Tax Deduction Rate At Source In Uk 2019-20.

From cagroups4all.blogspot.com

TO CA GROUPS Revised and Latest TDS Tax Deducted at Source Tax Deduction Rate At Source In Uk 2019-20 Scottish taxpayers are taxed at different rates on general i. The widening of the basic. this annex includes budget 2020 announcements of the main rates and allowances. the amount of income tax you deduct from your employees depends on their tax code and how much of their. 2019/2020 tax rates and allowances. Income tax rates 2020/21 (2019/20) a. Tax Deduction Rate At Source In Uk 2019-20.

From switch.payfit.com

tax — what's it all about? Tax Deduction Rate At Source In Uk 2019-20 Come (see below).to the extent that savings. Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. these rates are applied after your tax free allowance has been deducted from your gross wage. How much income tax you pay in each tax year depends on: Scottish taxpayers are taxed at different rates. Tax Deduction Rate At Source In Uk 2019-20.

From www.aarp.org

Give to Charity, but Don’t Count on a Tax Deduction Tax Deduction Rate At Source In Uk 2019-20 Come (see below).to the extent that savings. Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. How much income tax you pay in each tax year depends on: The widening of the basic. Click to select a tax section. this annex includes budget 2020 announcements of the main rates and allowances.. Tax Deduction Rate At Source In Uk 2019-20.

From angelaygoldarina.pages.dev

Tax Brackets 2024/25 Uk Elita Heloise Tax Deduction Rate At Source In Uk 2019-20 How much income tax you pay in each tax year depends on: 2019/2020 tax rates and allowances. these rates are applied after your tax free allowance has been deducted from your gross wage. The widening of the basic. Come (see below).to the extent that savings. this annex includes budget 2020 announcements of the main rates and allowances. Income. Tax Deduction Rate At Source In Uk 2019-20.

From napkinfinance.com

What are Tax Deductions? Napkin Finance Tax Deduction Rate At Source In Uk 2019-20 this annex includes budget 2020 announcements of the main rates and allowances. Scottish taxpayers are taxed at different rates on general i. Income tax rates 2020/21 (2019/20) a 0% starting rate applies to the first £5,000 of savings income. Click to select a tax section. the amount of income tax you deduct from your employees depends on their. Tax Deduction Rate At Source In Uk 2019-20.